Guide to the Market: A Comprehensive Overview (as of 01/22/2026)

Today’s market, as of 01/22/2026, offers diverse tools like Google and Yahoo Finance for real-time data,

while Reuters and MarketWatch deliver breaking financial news globally․

CNN and Business Insider provide comprehensive stock market data,

and emerging technologies like ChatGPT are aiding in insightful market analysis․

I․ Understanding the Core Market Concepts

Navigating the market requires grasping fundamental principles․ Defining the market landscape involves recognizing diverse participants – from individual investors to institutional traders – all influencing price discovery․

Understanding their motivations is crucial․

Two primary analytical approaches exist: fundamental and technical analysis․ Fundamental analysis assesses intrinsic value based on economic factors, while technical analysis examines price charts and patterns to predict future movements․

Successful participation demands a blend of both․ Market capitalization, representing a company’s total value, is a key metric․

Staying informed through resources like Reuters and MarketWatch is paramount for informed decision-making in this dynamic environment․

I․ Understanding the Core Market Concepts

Grasping market dynamics requires understanding participants, analytical methods, and key metrics like market capitalization for informed investment decisions․

Defining the Market Landscape

The current market landscape, as of January 22, 2026, is characterized by rapid information flow and technological integration․ Global exchanges are interconnected, offering investors access to diverse opportunities, from U․S․ markets like the Dow Jones, S&P 500, and NASDAQ, to international data readily available through platforms like Google and Yahoo Finance․

Real-time quotes and analytics empower informed decision-making, while news sources such as Reuters and MarketWatch provide crucial updates․ This dynamic environment demands a strong understanding of market forces and the ability to interpret data effectively․ The landscape is constantly evolving, influenced by economic indicators and technological advancements․

Key Market Participants

The market comprises a diverse range of participants, each playing a crucial role in its function․ Individual investors, utilizing platforms like Yahoo Finance and Google Finance, contribute to daily trading volume․ Institutional investors, including hedge funds and mutual funds, wield significant influence through large-scale transactions․

Financial news outlets like Reuters, MarketWatch, CNN, and Business Insider act as key information disseminators, shaping market sentiment․ Regulatory bodies oversee market activity, ensuring fairness and transparency․ Technology providers, exemplified by ChatGPT’s analytical capabilities, are increasingly vital․ Understanding the motivations and actions of these participants is essential for navigating the market effectively․

Fundamental vs․ Technical Analysis

Two primary approaches dominate market analysis: fundamental and technical․ Fundamental analysis involves evaluating a company’s intrinsic value by examining financial statements, industry trends, and economic factors – a long-term perspective․ This contrasts with technical analysis, which focuses on historical price and volume data, utilizing charts and patterns to predict future movements․

Tools like those offered by Google Finance and MarketWatch support both methods․ While fundamental analysis seeks to understand why a stock should move, technical analysis aims to identify when it will move․ Many investors employ a combination of both, leveraging data from Reuters and CNN to inform their strategies․

II․ Major Market Indexes and Exchanges

The U․S․ market is largely represented by the Dow Jones, S&P 500, and NASDAQ, each tracking different segments of the economy․ Global exchanges offer diverse investment opportunities, accessible through platforms like Google Finance and Yahoo Finance, providing international market data․ Understanding market capitalization – the total value of a company’s outstanding shares – is crucial for assessing its size and influence․

These indexes serve as benchmarks for overall market performance, with real-time updates available from Reuters and CNN․ Investors monitor these indicators to gauge economic health and identify potential investment trends, utilizing data from Business Insider for comprehensive analysis․

II․ Major Market Indexes and Exchanges

Key U․S․ indexes like the Dow Jones, S&P 500, and NASDAQ, alongside global exchanges,

offer diverse investment avenues with real-time data readily available for informed decisions․

U․S․ Market Overview (Dow Jones, S&P 500, NASDAQ)

The Dow Jones Industrial Average, a price-weighted index, tracks 30 large, publicly-owned companies,

representing a snapshot of the U․S․ economy’s health․ The S&P 500, a market-capitalization-weighted index,

offers a broader representation of the U․S․ stock market, encompassing 500 leading companies․

Meanwhile, the NASDAQ Composite, heavily weighted towards technology companies,

reflects the performance of over 3,000 stocks listed on the NASDAQ exchange․

These indexes provide vital benchmarks for investors,

allowing them to gauge market trends and assess portfolio performance․

Daily updates on these markets are readily available through sources like MarketWatch and CNN,

providing insights into valuation, performance, and emerging stock trends․

International Market Data (Global Exchanges)

Global exchanges offer diverse investment opportunities beyond U․S․ borders,

requiring investors to consider varying economic conditions and geopolitical factors․

Reuters․com serves as a crucial online source for breaking international market and finance news,

providing up-to-date information on global economic events․

Accessing data from exchanges like the London Stock Exchange (LSE),

the Tokyo Stock Exchange (TSE), and the Shanghai Stock Exchange (SSE)

is essential for diversified portfolios․ Google Finance and Yahoo Finance both provide

international market data, enabling investors to track performance across different regions․

Understanding currency fluctuations and international trade policies

are key components of successful international market investment strategies․

Understanding Market Capitalization

Market capitalization, often called “market cap,” represents the total value of a company’s outstanding shares․

It’s calculated by multiplying the current share price by the number of shares available to the public․

This metric is a fundamental tool for investors assessing a company’s size and relative importance

within the broader market landscape․

Companies are typically categorized by market cap: large-cap, mid-cap, and small-cap․

Large-cap companies generally offer stability, while small-cap companies may present higher growth potential

but also carry increased risk․ MarketWatch provides resources for understanding company valuation and performance,

including market capitalization data․

Analyzing market cap alongside other financial metrics provides a more comprehensive view

of a company’s investment worthiness․

III․ Accessing Market Information & Tools

Navigating the market requires reliable access to real-time data and analytical tools․

Fortunately, numerous online platforms provide comprehensive market information․

Google Finance delivers up-to-date quotes, international exchange data, and financial news,

empowering informed investment decisions․

Yahoo Finance offers portfolio management resources,

alongside stock quotes and global market data․

For breaking financial news, Reuters and MarketWatch are invaluable resources,

providing timely updates on market movements․

Business Insider and CNN offer stock market data,

custom charts, and breaking news coverage․

These tools collectively provide a robust foundation for market analysis․

III․ Accessing Market Information & Tools

Utilize platforms like Google Finance, Yahoo Finance, Reuters, MarketWatch, Business Insider, and CNN for real-time data and comprehensive market insights․

Google Finance: Real-Time Quotes & Analytics

Google Finance stands as a premier destination for investors seeking up-to-the-minute market data and robust analytical tools․ It delivers real-time stock quotes, comprehensive charts, and crucial financial news, empowering users to make well-informed investment decisions․

Beyond basic quotes, Google Finance provides access to international exchanges, allowing investors to monitor global market trends․ Its analytics features delve into company performance, offering insights into financial health and potential growth․

The platform’s user-friendly interface simplifies complex data, making it accessible to both novice and experienced traders․ Google Finance also integrates seamlessly with other Google services, enhancing its overall utility for financial management and research․

Yahoo Finance: Portfolio Management & News

Yahoo Finance is a comprehensive platform offering free stock quotes, up-to-date news, and powerful portfolio management resources․ It’s designed to help individuals effectively manage their financial lives, from tracking investments to staying informed about market movements․

A key feature is its robust portfolio tracking tool, allowing users to monitor performance, analyze holdings, and receive personalized insights․ Yahoo Finance also provides extensive international market data, broadening investment horizons․

Beyond data, the platform fosters a community aspect, enabling social interaction among investors․ Furthermore, Yahoo Finance includes mortgage rate information, adding another layer of financial utility for its users, making it a central hub for financial information․

Reuters & MarketWatch: Breaking Financial News

Reuters․com stands as a premier online source for breaking international market and finance news, delivering up-to-the-minute coverage from every corner of the globe․ Its reporting focuses on providing timely and accurate information to inform investment decisions․

MarketWatch complements this with a daily update of the U․S․ market, offering insights into valuation, performance, and emerging stock trends․ It’s a go-to resource for identifying market gainers and losers, and understanding broader financial and business news․

Both platforms provide critical data and analysis, empowering investors to navigate the complexities of the market with confidence and stay ahead of evolving economic landscapes․

Business Insider & CNN: Stock Market Data & Trends

Business Insider offers a dynamic stock market site featuring real-time data, customizable charts, and breaking news coverage․ It’s designed to provide investors with a comprehensive view of market activity, spanning stocks, commodities, currencies, funds, ETFs, and interest rates․

CNN’s business section delivers extensive stock market data, including US and world market views, after-hours trading updates, and crucial stock market activity reports․

These platforms excel at presenting complex information in an accessible format, enabling both novice and experienced investors to track performance and identify emerging trends effectively․

IV․ Analyzing Market Trends & Performance

Effective market analysis hinges on identifying both gainers and losers, providing crucial insights into current market sentiment․ Tracking stock valuation and performance metrics is paramount, allowing investors to assess the health and potential of individual investments․

Utilizing market charts and visualizations transforms raw data into understandable patterns, revealing trends and potential opportunities․ Daily updates from sources like MarketWatch offer a continuous stream of information on market news, valuation, and performance․

This proactive approach empowers informed decision-making, enabling investors to navigate market fluctuations with greater confidence and precision․

IV․ Analyzing Market Trends & Performance

MarketWatch delivers daily updates on stock valuation, performance, gainers, and losers,

while charts visualize trends for informed investment decisions and strategic analysis․

Identifying Market Gainers & Losers

Pinpointing market gainers and losers is crucial for dynamic trading strategies․ Daily updates from sources like MarketWatch provide a snapshot of stocks experiencing significant price increases or declines․ Analyzing these movements requires considering volume alongside price changes; a surge in volume often validates the trend․

Understanding why stocks are moving is paramount․ News events, earnings reports, and industry-specific developments frequently drive these fluctuations․ Identifying these catalysts allows for more informed decisions․ Furthermore, comparing current performance against historical data reveals potential outliers and opportunities․ Remember, identifying gainers and losers is just the first step – thorough research is essential before investing․

Tracking Stock Valuation & Performance

Effectively tracking stock valuation and performance demands a multi-faceted approach․ Utilizing resources like Yahoo Finance and Google Finance provides access to key metrics such as Price-to-Earnings (P/E) ratios, Earnings Per Share (EPS), and Return on Equity (ROE)․ Comparing these metrics to industry averages offers valuable context․

Monitoring historical performance is equally vital․ Examining trends over various timeframes – daily, weekly, monthly, and annually – reveals patterns and potential risks․ Furthermore, understanding market capitalization helps assess a company’s size and stability․ Consistent tracking, combined with a grasp of fundamental analysis, empowers investors to make well-informed decisions․

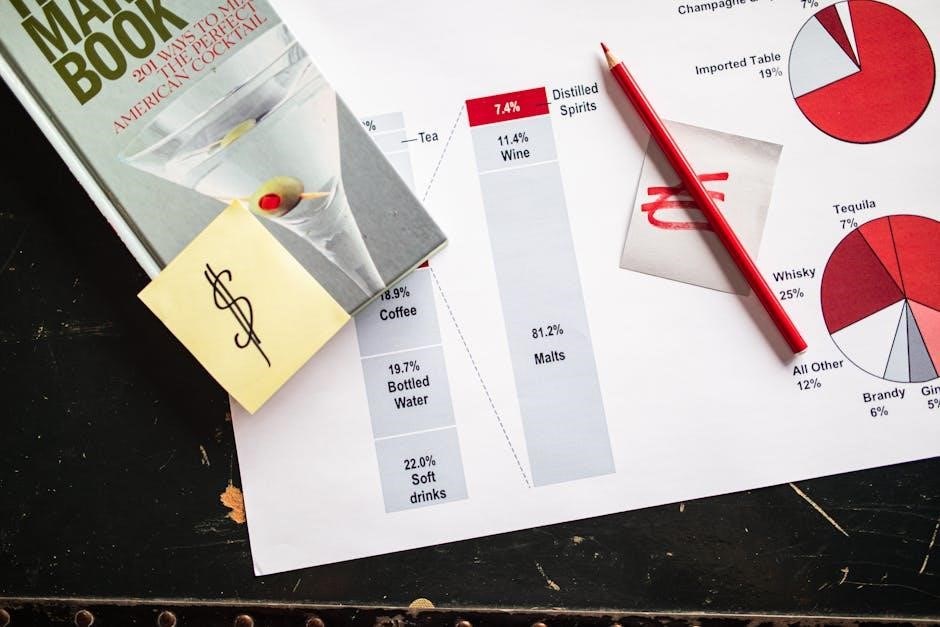

Utilizing Market Charts & Visualizations

Market charts and visualizations are indispensable tools for understanding complex data․ Platforms like Yahoo Finance, Google Finance, and Business Insider offer a variety of chart types – line charts, bar charts, candlestick charts – each revealing different aspects of stock performance․

Visualizing trends, patterns, and volatility becomes significantly easier with these tools․ Candlestick charts, for example, illustrate open, high, low, and closing prices, providing a quick snapshot of price action․ Analyzing volume alongside price movements offers further insights․ Mastering chart interpretation is crucial for identifying potential entry and exit points, ultimately enhancing trading strategies․

V․ The Role of Technology in Market Analysis

Technology is revolutionizing market analysis, moving beyond traditional methods․ ChatGPT, for instance, can analyze vast datasets to identify trends and patterns, offering potential crypto market insights, though its accuracy relies on data quality․

Data analytics are becoming central to modern marketing, enabling businesses to understand customer behavior and optimize campaigns․ Furthermore, identifying and addressing sales funnel leakage – where potential customers drop off – is now data-driven․ These advancements empower investors and marketers alike, providing a competitive edge in today’s fast-paced market environment․

V․ The Role of Technology in Market Analysis

ChatGPT and data analytics are transforming market insights, while pinpointing sales funnel issues boosts efficiency․ Technology empowers informed decisions․

ChatGPT for Crypto Market Insights

Leveraging ChatGPT for cryptocurrency market analysis presents a novel approach, offering the potential to decipher complex trends and patterns․ However, it’s crucial to acknowledge its limitations; ChatGPT isn’t a predictive oracle․ Its accuracy is fundamentally reliant on the quality and reliability of the data it receives․

To effectively generate crypto market insights, users must provide ChatGPT with accurate historical data, current market conditions, and specific analytical requests․ The tool excels at identifying correlations, summarizing news sentiment, and even generating potential trading scenarios, but always requires human oversight and critical evaluation․

Remember, ChatGPT is a powerful assistant, not a replacement for thorough research and sound investment judgment․

Data Analytics in Modern Marketing

Modern marketing transcends creative campaigns; it’s deeply rooted in data analysis․ As we progress through 2026, B2B marketing is undergoing a significant transformation, driven by the need to quantify results and optimize strategies․ Analyzing data allows marketers to move beyond intuition and make informed decisions based on concrete evidence․

Key areas of focus include tracking website traffic, analyzing customer behavior, measuring campaign performance, and identifying emerging trends․ This data-driven approach enables marketers to personalize experiences, improve targeting, and maximize return on investment․

Ultimately, data analytics empowers marketers to tell compelling stories supported by quantifiable results, demonstrating the value of their efforts․

Identifying and Addressing Sales Funnel Leakage

Every sales funnel experiences attrition; potential customers inevitably drop off before conversion․ The critical task isn’t eliminating all leakage, but identifying where it occurs and addressing the root causes․ Analyzing each stage – awareness, interest, decision, and action – reveals bottlenecks hindering progress․

Common leakage points include unclear messaging, complicated checkout processes, lack of personalized follow-up, and insufficient lead nurturing․ Data analytics plays a vital role in pinpointing these areas, allowing for targeted improvements․

By optimizing each stage, businesses can recapture lost opportunities and significantly boost conversion rates, ultimately maximizing revenue․

VI; Key Performance Indicators (KPIs) for Market Success

Establishing clear goals and KPIs is paramount for gauging market performance․ These metrics move beyond vanity numbers, focusing on actionable insights․ Key indicators include market penetration – the extent your product is adopted within the target audience – and customer acquisition cost (CAC), revealing marketing efficiency․

Return on Investment (ROI) analysis is crucial, demonstrating the profitability of marketing efforts․ Tracking website traffic, lead generation rates, and conversion rates provides a holistic view․

Regularly monitoring these KPIs allows for data-driven adjustments, ensuring strategies remain aligned with overall business objectives and maximizing market success․

VI․ Key Performance Indicators (KPIs) for Market Success

KPIs begin with establishing clear goals, then measuring market penetration and analyzing ROI to optimize strategies for sustained, profitable growth․

Establishing Clear Goals and KPIs

Defining specific, measurable, achievable, relevant, and time-bound (SMART) goals is paramount for market success․ These goals should directly align with overall business objectives, providing a clear roadmap for marketing efforts․

Key Performance Indicators (KPIs) then become the quantifiable metrics used to track progress towards these goals․ Examples include website traffic, lead generation rates, conversion rates, customer acquisition cost (CAC), and customer lifetime value (CLTV)․

Regular monitoring and analysis of KPIs are crucial for identifying areas of strength and weakness․ This data-driven approach allows for agile adjustments to marketing strategies, maximizing ROI and ensuring continuous improvement․ Without clearly defined KPIs, measuring market effectiveness remains subjective and unreliable․

Measuring Market Penetration

Assessing market penetration reveals the extent to which a product or service is being adopted by available customers․ This is often calculated as the percentage of potential customers currently using the offering․ Analyzing this metric provides insights into growth opportunities and competitive positioning․

Key indicators include sales volume, revenue market share, and customer acquisition rates within a defined target market․ Tracking these metrics over time highlights the effectiveness of marketing campaigns and sales strategies․

Furthermore, understanding brand awareness and customer loyalty are vital components․ Low penetration despite high awareness suggests potential issues with product appeal or pricing, requiring strategic adjustments to maximize market reach and capture a larger share․

Return on Investment (ROI) Analysis

ROI analysis is crucial for evaluating the profitability of market investments․ It measures the gain or loss generated relative to the cost of an investment, expressed as a percentage․ A positive ROI indicates a profitable venture, while a negative ROI signals a loss․

Calculating ROI involves subtracting the initial investment from the net profit, then dividing the result by the initial investment․ This provides a clear picture of investment efficiency․

Analyzing ROI across different marketing channels and campaigns helps optimize resource allocation․ Identifying high-ROI activities allows for increased investment, while underperforming areas can be adjusted or discontinued, maximizing overall market success and financial returns․